(d) Corporate annual reports contain both mandatory and voluntary disclosures.Required:(i) Distinguish, using examples, between mandatory and voluntary disclosures in the annual reports ofpublic listed companies. (6 marks)

题目

(d) Corporate annual reports contain both mandatory and voluntary disclosures.

Required:

(i) Distinguish, using examples, between mandatory and voluntary disclosures in the annual reports of

public listed companies. (6 marks)

相似考题

更多“(d) Corporate annual reports contain both mandatory and voluntary disclosures.Required:(i) Distinguish, using examples, between mandatory and voluntary disclosures in the annual reports ofpublic listed companies. (6 marks)”相关问题

-

第1题:

(ii) Explain why the disclosure of voluntary information in annual reports can enhance the company’s

accountability to equity investors. (4 marks)

正确答案:

(ii) Accountability to equity investors

Voluntary disclosures are an effective way of redressing the information asymmetry that exists between management and

investors. In adding to mandatory content, voluntary disclosures give a fuller picture of the state of the company.

More information helps investors decide whether the company matches their risk, strategic and ethical criteria, and

expectations.

Makes the annual report more forward looking (predictive) whereas the majority of the numerical content is backward

facing on what has been.

Helps transparency in communicating more fully thereby better meeting the agency accountability to investors,

particularly shareholders.

There is a considerable amount of qualitative information that cannot be conveyed using statutory numbers (such as

strategy, ethical content, social reporting, etc).

Voluntary disclosure gives a more rounded and more complete view of the company, its activities, strategies, purposes

and values.

Voluntary disclosure enables the company to address specific shareholder concerns as they arise (such as responding

to negative publicity).

[Tutorial note: other valid points will attract marks] -

第2题:

(ii) Explain the organisational factors that determine the need for internal audit in public listed companies.

(5 marks)

正确答案:

(ii) Factors affecting the need for internal audit and controls

(Based partly on Turnbull guidance)

The nature of operations within the organisation arising from its sector, strategic positioning and main activities.

The scale and size of operations including factors such as the number of employees. It is generally assumed that larger

and more complex organisations have a greater need for internal controls and audit than smaller ones owing to the

number of activities occurring that give rise to potential problems.

Cost/benefit considerations. Management must weigh the benefits of instituting internal control and audit systems

against the costs of doing so. This is likely to be an issue for medium-sized companies or companies experiencing

growth.

Internal or external changes affecting activities, structures or risks. Changes arising from new products or internal

activities can change the need for internal audit and so can external changes such as PESTEL factors.

Problems with existing systems, products and/or procedures including any increase in unexplained events. Repeated or

persistent problems can signify the need for internal control and audit.

The need to comply with external requirements from relevant stock market regulations or laws. This appears to be a

relevant factor at Gluck & Goodman. -

第3题:

(b) Using sensitivity analysis, estimate by what percentage each of the under-mentioned items, taken separately,

would need to change before the recommendation in (a) above is varied:

(i) Initial outlay;

(ii) Annual contribution. (4 marks)

正确答案:

-

第4题:

(c) mandatory continuing professional development (CPD) requirements. (5 marks)

正确答案:(c) Continuing Professional Development (CPD)

CPD is defined5 as ‘the continuous maintenance, development and enhancement of the professional and personal knowledge

and skills which members of ACCA require throughout their working lives’.

All professional accountants need to maintain their competence and develop new skills to be effective in their current and

future employment. CPD helps keep accountants in practice employable and maintains their reputation with employers,

clients and the public. It also helps maintain the accounting profession’s reputation for producing and supporting high calibre

individuals. Therefore, CPD is something which professional accountants should take personal responsibility for, and be doing

as part of their everyday work.Mandatory CPD for active members of IFAC member bodies (such as ACCA) was introduced with effect from 1 January 2005

onwards. ACCA has introduced CPD as a requirement for all active members, subject to the phasing-in dates (and waivers).

Tutorial note: IFAC issued International Education Standard (IES) 7, which requires the introduction of CPD for all active

members of IFAC member bodies.

ACCA practising certificate and insolvency licence holders are still required to participate in technical CPD training. All other

members will also be asked to state on their annual CPD return that they maintain competence in professional ethics.

The scheme is being introduced in phases:

■ phase 1 (2005) – members admitted since 1 January 2001, and all practising certificate and insolvency licence

holders;

■ phase 2 (2006) – members admitted between 1 January 1995 and 31 December 2000;

■ phase 3 (2007) – all remaining members.

Tutorial note: However, ACCA encouraged all members to adopt the scheme from 1 January 2005.

Affiliates join the CPD scheme on 1 January following their date of admittance to membership.

There are two routes to participation in ACCA’s CPD scheme:

(1) the unit scheme route (40 units approximate to 40 hours required each year); and

(2) the approved CPD employer route (i.e. where employers are recognised as effectively providing ACCA members with

CPD).

Tutorial note: Alternatively, if an ACCA member is also a member of another IFAC accounting body and that CPD scheme

is compliant with IFAC’s CPD IES 7, they may choose to follow that body’ s route. -

第5题:

Both Alan and Diana ___ busywith their reports.A.has been

B.is

C.are

D.was

正确答案:C

-

第6题:

Which of the following would contain information regarding network device alerts using SNMP?()A. Syslog

B. Audit log

C. History log

D. Ping sweep reports

参考答案:A

-

第7题:

The compass rose on a nautical chart indicates both variation and ______.

A.deviation

B.annual rate of variation change

C.precession

D.compass error

正确答案:B

-

第8题:

Several people, () I listed below, have not submitted their reports.

- A、that

- B、whom

- C、which

- D、who

正确答案:B -

第9题:

Which of the following would contain information regarding network device alerts using SNMP?()

- A、Syslog

- B、Audit log

- C、History log

- D、Ping sweep reports

正确答案:A -

第10题:

Which two statements are true about terms in a routing policy?()

- A、A then statement is mandatory in a term

- B、If a term does not contain a from statement, all routers match

- C、If a term does not contain a from statement, the Junos OS will not commit

- D、A then statement is not mandatory in a term

正确答案:A,B -

第11题:

单选题As his moviemaking career began to wane, Jerry Lewis remained in the public eye by hosting both a variety show and on an annual telethon with benefits for the Muscular Dystrophy Association.Aon an annual telethon with benefits for the Muscular Dystrophy Association

Ban annual telethon with benefits to the Muscular Dystrophy Association

Cbenefiting the Muscular Dystrophy Association with his annual telethon

Dan annual telethon benefiting the Muscular Dystrophy Association

Ethe Muscular Dystrophy Association with an annual telethon

正确答案: D解析:

原句需要用平行结构。D使用了平行结构,故选D。 -

第12题:

多选题Which two are differences between IGMPv2 and IGMPv3 reports?()AIGMPv3 has the ability to include or exclude source lists.

BAll IGMPv3 hosts send reports to destination address 224.0.0.22.

COnly IGMPv2 reports may contain multiple group state records.

DAll IGMPv3 hosts send reports to destination address 224.0.0.23.

EIGMPv2 does not support the Leave Group message.

正确答案: E,D解析: 暂无解析 -

第13题:

(c) Risk committee members can be either executive or non-executive.

Required:

(i) Distinguish between executive and non-executive directors. (2 marks)

正确答案:

(c) Risk committee members can be either executive on non-executive.

(i) Distinguish between executive and non-executive directors

Executive directors are full time members of staff, have management positions in the organisation, are part of the

executive structure and typically have industry or activity-relevant knowledge or expertise, which is the basis of their

value to the organisation.

Non-executive directors are engaged part time by the organisation, bring relevant independent, external input and

scrutiny to the board, and typically occupy positions in the committee structure. -

第14题:

3 Better budgeting in recent years may have been seen as a movement from ‘incremental budgeting’ to alternative

budgeting approaches.

However, academic studies (e.g. Beyond Budgeting – Hope & Fraser) argue that the annual budget model may be

seen as (i) having a number of inherent weaknesses and (ii) acting as a barrier to the effective implementation of

alternative models for use in the accomplishment of strategic change.

Required:

(a) Identify and comment on FIVE inherent weaknesses of the annual budget model irrespective of the budgeting

approach that is applied. (8 marks)

正确答案:

(a) The weaknesses of traditional budgeting processes include the following:

– many commentators, including Hope and Fraser, contend that budgets prepared under traditional processes add little

value and require far too much valuable management time which would be better spent elsewhere.

– too heavy a reliance on the ‘agreed’ budget has an adverse impact on management behaviour which can become

dysfunctional having regard to the objectives of the organisation as a whole.

– the use of budgeting as base for communicating corporate goals, setting objectives, continuous improvement, etc is seen

as contrary to the original purpose of budgeting as a financial control mechanism.

– most budgets are not based on a rational causal model of resource consumption but are often the result of protracted

internal bargaining processes.

– conformance to budget is not seen as compatible with a drive towards continuous improvement.

– budgeting has an insufficient external focus. -

第15题:

(ii) Compute the annual income tax saving from your recommendation in (i) above as compared with the

situation where Cindy retains both the property and the shares. Identify any other tax implications

arising from your recommendation. Your answer should consider all relevant taxes. (3 marks)

正确答案:

-

第16题:

4 (a) ISA 701 Modifications to The Independent Auditor’s Report includes ‘suggested wording of modifying phrases

for use when issuing modified reports’.

Required:

Explain and distinguish between each of the following terms:

(i) ‘qualified opinion’;

(ii) ‘disclaimer of opinion’;

(iii) ‘emphasis of matter paragraph’. (6 marks)

正确答案:

4 PETRIE CO

(a) Independent auditor’s report terms

(i) Qualified opinion – A qualified opinion is expressed when the auditor concludes that an unqualified opinion cannot be

expressed but that the effect of any disagreement with management, or limitation on scope is not so material and

pervasive as to require an adverse opinion or a disclaimer of opinion.

(ii) Disclaimer of opinion – A disclaimer of opinion is expressed when the possible effect of a limitation on scope is so

material and pervasive that the auditor has not been able to obtain sufficient appropriate audit evidence and accordingly

is unable to express an opinion on the financial statements.

(iii) Emphasis of matter paragraph – An auditor’s report may be modified by adding an emphasis of matter paragraph to

highlight a matter affecting the financial statements that is included in a note to the financial statements that more

extensively discusses the matter. Such an emphasis of matter paragraph does not affect the auditor’s opinion. An

emphasis of matter paragraph may also be used to report matters other than those affecting the financial statements

(e.g. if there is a misstatement of fact in other information included in documents containing audited financial

statements).

(iii) is clearly distinguishable from (i) and (ii) because (i) and (ii) affect the opinion paragraph, whereas (iii) does not.

(i) and (ii) are distinguishable by the degree of their impact on the financial statements. In (i) the effects of any disagreement

or limitation on scope can be identified with an ‘except for …’ opinion. In (ii) the matter is pervasive, that is, affecting the

financial statements as a whole.

(ii) can only arise in respect of a limitation in scope (i.e. insufficient evidence) that has a pervasive effect. (i) is not pervasive

and may also arise from disagreement (i.e. where there is sufficient evidence). -

第17题:

Commonalties of nonrecognition transactions include that.I. deferring a loss is mandatory on like-kind exchanges.II. deferring a loss is mandatory on involuntary conversions?()A.Only statement I is correct

B.Only statement II is correct

C.Both statements are correct

D.Neither statement is correct

答案:B

-

第18题:

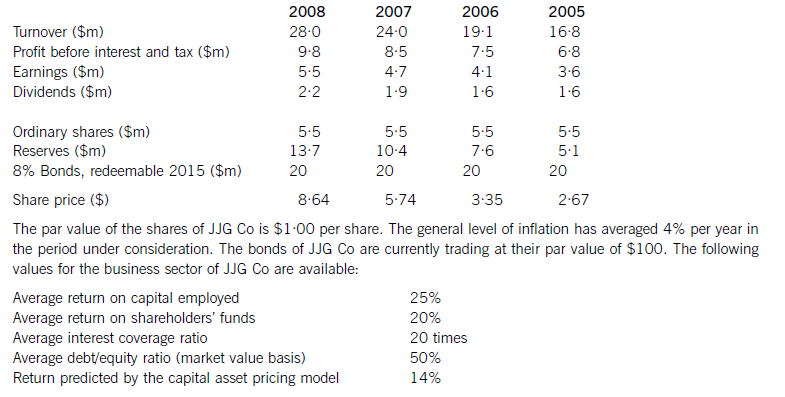

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第19题:

Several people, () I listed below, have not submitted their reports.

Athat

Bwhom

Cwhich

Dwho

B

略 -

第20题:

Which two are differences between IGMPv2 and IGMPv3 reports?()

- A、IGMPv3 has the ability to include or exclude source lists.

- B、All IGMPv3 hosts send reports to destination address 224.0.0.22.

- C、Only IGMPv2 reports may contain multiple group state records.

- D、All IGMPv3 hosts send reports to destination address 224.0.0.23.

- E、IGMPv2 does not support the Leave Group message.

正确答案:A,B -

第21题:

If authentication is enabled,which statement is true?()

- A、client reports will display authenticated usernames

- B、client reports will display both the username and IP address of the clients

- C、client reports are not affected by authentication

- D、client reports will display the IP address of the authentication server

正确答案:A -

第22题:

Using the reports server how would you force the orders report in the orders entry application to run every six hours?()

- A、Schedule the report's execution in the queue manager.

- B、Schedule the reports execution using the R30RQM command line with scheduled parameter.

- C、Create a trigger in the application to execute the report every six hours.

- D、You cannot schedule a reports execution.

正确答案:A -

第23题:

多选题Which two statements are true about terms in a routing policy?()AA then statement is mandatory in a term

BIf a term does not contain a from statement, all routers match

CIf a term does not contain a from statement, the Junos OS will not commit

DA then statement is not mandatory in a term

正确答案: C,B解析: 暂无解析